RiskAMP is a full-featured Monte Carlo Simulation Engine for Microsoft Excel®. With the RiskAMP Add-in, you can add Risk Analysis to your spreadsheet models quickly, easily, and for a fraction of the price of competing packages. The PERT distribution for cost and project modeling. An easy-to-use wizard for creating tables and charts.

First, suppose that bikers arrive to Station 1 (station id =1) according to a nonstationary Poisson process. Complete the below table (enclosed picture file) of arrival rates at Station 1.

Hint: Create a timevalue column. Excel ‘Timevalue (time text)’ returns the decimal number of the time represented by a text string. The decimal number is a value ranging from 0 (zero) to 0.99988426, representing the times from 0:00:00 (12:00:00 AM) to 23:59:59 (11:59:59 P.M.). For example, TIMEVALUE(“1-June-2017 6:35 AM”) = 0.2743. Use the histogram of the timevalue to compute the arrival rates.

- @RISK risk analyis software gives you multiple options for saving Monte Carlo simulations you have run and comparing them with other simulations. These include: Storing simulations in your Excel workbook Saving simulations as a separate.RSK5 file outside the workbook Using the @RISK Library for storing and comparing different simulations.

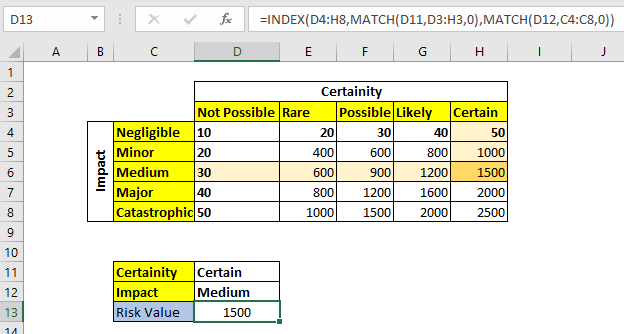

- Risk of hazard = likelihood of occurrence (probability). Severity of harm. We will walk through the steps below to understand the process. Figure 1: How to Use a Risk Matrix. The formula in Cell D13 is given as: =INDEX(C5:G9,MATCH(Severity,B5:B9,0),MATCH(Likelihood,C4:G4,0)) Setting up the Data. We will set up the risk matrix by doing.

- Applies to: @RISK 6.1, 6.2, 6.3, 7.0 in 32-bit Excel 2013 or 2016 My simulation used to run okay, but now the same file crashes Excel during simulation. If you're running 64-bit Excel, or Excel 2010 or earlier, this article does not apply to you.

- On @RISK for Cost and Schedule Risk using Risk Registers (with example model) @RISK can be used in conjunction with MS Project and Excel to model the schedule and cost risks inherent in large, complex projects. This example demonstrates the use of @RISK to build a complete model of the construction of a new commercial venue.

Second, assign a destination (end station id) to each arrival at Station 1 by using a discrete probability distribution of this form: DISC(p1,1, p2,2,…p12,12)

Determine the value of p1, p2…p12 using the relative frequency bar chart of ‘end station id’. Copy and paste your Excel worksheet.

Finally, build a probabilistic model for the trip duration from Station 1 to Station i, with i=1,2,…12

i. First step is to remove outliers. If a bike has been rent out for more than 24 hours at a time, it is considered lost or stolen. Remove any trips longer than 24 hours (86,400 seconds). You can also remove more outliers if you think it is necessary.

ii. Considering the scatterplot below (Word document) and the location of the 12 stations, determine the probability distribution of the trip duration from Station 1 to Station i, with i =1, 2,…12.

You can use Arena Input Analyzer, @RISK, or any other statistical software you like. You may combine some (or even all) end stations to determine input probability distributions. Copy and paste your Arena Input analyzer results or Excel worksheet.

Copy and paste your Excel worksheet.

@RISK’s use of Monte Carlo simulation allows for powerful features, like RiskSimtable.

Risk Excel Add-in

The RiskSimtable feature can be used to run multiple simulations to test the sensitivity of the risk analysis model, for example to changes in the parameters of a distribution. This model is of a business with a base case expected revenue of 100 and cost of 80, giving a profit of 20.

The risk model assumes that the revenue and cost distributions are determined from a mean and standard deviation. The RiskSimtable feature is used to test the sensitivity of the distribution of profit to changes in the standard deviation of the revenues. Three values are tested of which the first is our original @RISK model. The number of simulations is therefore set at 3. A RiskSimtable can be set up either by directly typing in the required format, or by inserting it as for other Excel functions via the Insert Function menu option. The model also uses some @RISK statistical analysis functions to report the probability for each simulation that the profit exceeds 50.

@risk Excel

» Download the example: BasicBusiness.Simtable.xls